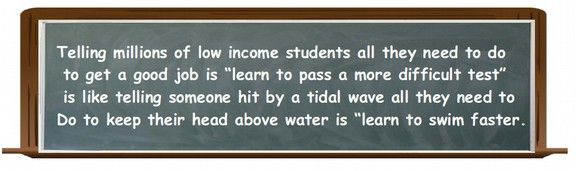

We have shown that Common Core tests, including the SBAC test, the PARCC test and the Pearson GED test are more difficult to to pass not because of the change to Common Core standards, but because they use NAEP “Hard” questions instead of NAEP “Medium” questions. This artificial increase in difficulty insures that the vast majority of students will fail Common Core tests. The typical reason given for dramatically increasing the difficulty of high stakes tests is to prepare students to be “career and college ready.” In this section, we will expose the fact that even if students are able to pass Common Core tests, most will not have a high paying high tech job waiting for them at the end of this grueling marathon. For example, we already have many more high tech workers than high tech jobs. Swimming faster is not the solution to this problem when the problem is that wealth is concentrated in the hands of a few billionaires. Instead of expecting kids to swim faster, we need to stop the tidal wave of wealth being transferred from the poor to the rich and use these funds to restore good paying jobs for the next generation.

Comparing US High Stakes Tests to China

One of us (Elizabeth Hanson) has been working as an ESL instructor – including working with students from China - for 30 years. Asian kids come to study in the U.S. because either they did not do well enough on their high stakes tests to enter university in China, or their parents did not want their kids to suffer the massive amount of studying required to pass the Gao Kao – a two day test given to seniors in China. Only half the students who take the Gao Kao pass it. So Common Core tests will do to our kids what the Gao Kao test does to kids in China. http://factsanddetails.com/china/cat13/sub82/item1649.html

What is the real reason for “College and Career Ready” testing?

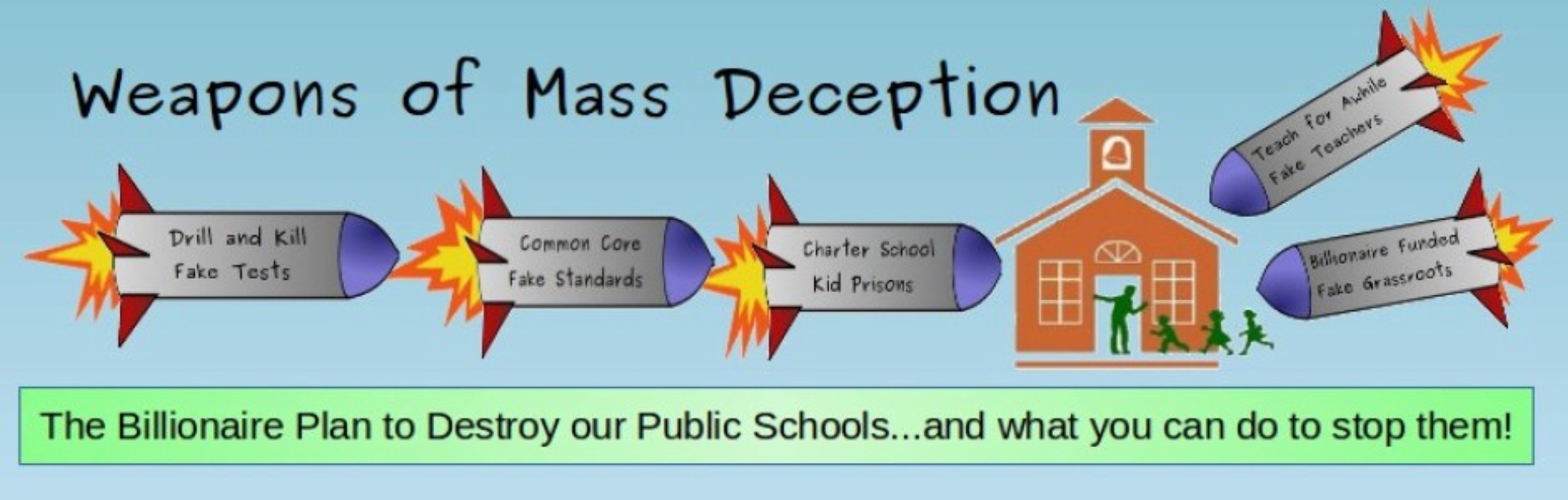

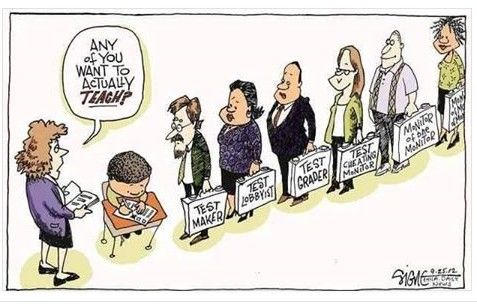

What seems to be going on is this: Some billionaire-corporate types started a myth that Americans were falling behind the rest of the world, and then they stepped in with the solution: copy-written educational standards, tests, curricula and materials and a system for data-mining to write reports to justify the whole mess. Look at Pearson Publishing, a UK company, which owns the GED and publishes high stakes tests and curricula. They earn $4 billion in sales annually in North America from solving the “problem” of our kids not being “College and Career Ready”. What is happening to our education system is very simple and very devious… Create a problem and create a market to solve the problem.

How Designed to Fail Tests are Related to our Designed to Fail Economy

It would be one thing if we as a people really were failing- if we had somehow become less creative, less productive. It would be one thing if we had a real demand for workers and didn’t have enough workers to fill that demand. But those aren’t the problems. The problem is that we’ve off-shored and out sourced our jobs. We don’t have much of an economy for the bottom 60% of Americans. And public education with its budget of $750 billion a year is in the corporate sights. Our kids have become commodities. The ed-refomers have created an industry with “designed to fail” tests. Let’s turn to the real problem: the US economy which has also been “designed to fail.”

Free Trade versus Fair Trade

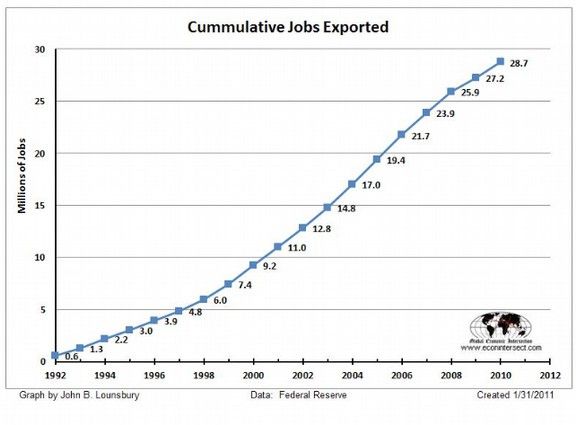

Let’s take a look at this robust economy that we are preparing our kids for when they get College and Career Ready. Where are all of those great “Career Ready” jobs going to be? What ever happened to Detroit and Camden and Pittsburgh and other formerly great cities in the U.S? Due to “free trade” agreements, 30 million jobs have been lost in the U.S. since 1992 and with more trade agreements in the wings - TPP and TTIP - many more jobs are sure to be off-shored and out-sourced. If our government really cared about the people, would they have allowed free trade agreements to go through? Our students are forced to struggle with high stakes tests where many of the questions are years above their reading ability – and after all of this high failure rate testing, all they get from it is a failed economy that results in a dead-end future So much for college and career ready. It is nothing but an empty marketing slogan to distract us from the truth about our economy that the billionaires are shipping our jobs overseas.

We need more real jobs not more fake tests

Billionaires claim that we need to get our kids college and career ready to be prepared to work in this new high tech economy. But there is no truth to this claim. According to the Bureau of Labor statistics, of the 30 jobs which will have the most demand and openings in the U.S.- from now until 2022 - 2/3 won’t even require a college degree. Examples of the jobs we will have are store clerks, food service workers, nursing assistants, day laborers… those jobs will be in high demand. (http://www.bls.gov/news.release/ecopro.t05.htm)

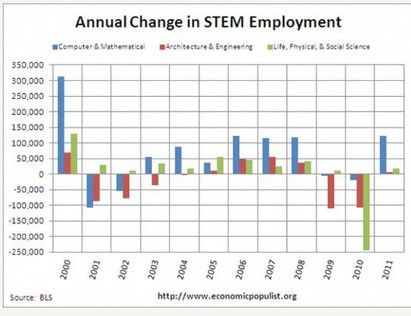

What about STEM jobs?

STEM jobs pay well. However, according to the Census bureau, only 1 in 4 Stem graduates are working at a STEM job that requires their degree. The others are working at jobs that don’t require their degree.

(http://www.census.gov/newsroom/press-releases/2014/cb14-130.html)

Moreover, look at the low growth in STEM jobs.

http://www.economicpopulist.org/content/congress-betrays-us-stem-worker-once-again

Where are these math and STEM jobs?

The biggest myth we need to refute is the claim that there are “millions of good paying job openings” just waiting to be filled if only we could somehow raise the math ability of high school dropouts (or high school seniors, or college seniors). The claim is that the skills of the current labor pool are “not aligned” with the available jobs. These phony claims sound good and have been repeated so often in the corporate media, that many people believe they must be true. But the “millions of jobs awaiting those with better math skills” claim is not supported by any actual facts. For example, there are already hundreds of thousands of unemployed high tech workers in the United States. In fact, the 2010 US Census confirmed there are 1.8 million unemployed engineers in the US.

Hundreds of thousands of unemployed high tech workers in the US

According to an article on ComputerWorld.com, there are already more than 241,000 unemployed U.S. high tech workers – all of them with very good math skills. High tech jobs have been outsourced to H1B foreign workers not because there are not enough workers in the US to fill these positions – but rather because wealthy multinational corporations can find cheaper workers in other countries to do high tech jobs due to the lower standard of living in other countries. There was a special report on this scam on the PBS News Hour on July 24 2013:

http://www.pbs.org/newshour/making-sense/the-bogus-high-tech-worker-sho/

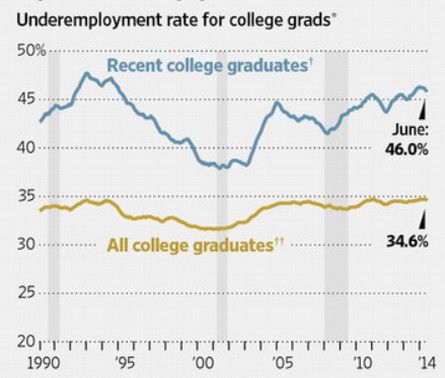

Close to half of all recent college graduates are working at jobs that don’t require a college degree, jobs like nursing assistant, store clerk office worker, food service, and on top of that they are on average $30,000 in debt. http://www.usnews.com/news/articles/2014/11/13/average-student-loan-debt-hits-30-000

Here is a quote from the PBS report: “High-tech industries are now using guest workers to fill two-thirds of new IT jobs. At the same time, U.S. colleges are graduating more than twice as many science, technology, engineering and math (STEM) graduates than the number of STEM openings generated by our economy each year... Only half of engineering graduates find engineering jobs.”

Tech industry insiders have admitted at conferences that most of the high tech jobs listed are fake jobs that do not even exist. The only purpose in listing these fake jobs is to fool the US Congress into increasing the number of foreign workers allowed into the US. In a survey of college graduates by the National Center for Educational Statistics, one third of computer science graduates reported there were no IT jobs available.

Currently, U.S. colleges graduate far more scientists and engineers than find employment in those fields every year — about 200,000 more STEM graduates than STEM jobs per year. These are all people with a high school diploma and a college diploma and excellent math skills that cannot find a job. If these highly qualified college graduates cannot find jobs, how is pushing a high school drop out into learning advanced algebra going to help them find a job?

Corporate Outsourcing of Jobs and Wealth

Corporate propaganda has falsely claimed that we do not have enough skilled workers in America and we therefore have to import H1B visa workers from overseas. But the truth is that there is no shortage of skilled American workers. Often dozens of qualified Americans apply for every job. In fact, the workers imported to replace American Hi Tech workers often had LESS training than the workers they were replacing. Wealthy corporations are simply bringing in foreign workers to drive down wages.

“These foreign workers are paid only one third of what the laid off American workers had earned… American workers were even required to train the Indian workers who replaced them.”

Dan Stein, Executive Director, Federation for American Immigration Reform http://www.fairus.org/site/PageServer?pagename=leg_legislationb1f2

Despite the availability of American workers, the amount of foreign workers has been allowed to increase by over 400% in the past 10 years. The result of this corporate corruption is that hundreds of thousands of US workers have been displaced by cheaper foreign workers who are themselves abused in order to drive down wages in the US computer industry. Many H1B workers are being paid only $10 an hour. In some cases H1B workers were paid only $18,000 for a year of work. Eventually, these same jobs are outsourced overseas as these guest workers, trained by US computer programmers, take themselves and the jobs back to their home country.

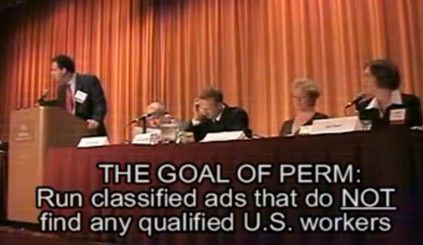

But what about all of the ads in the paper for good paying computer jobs?Nearly all of these ads are for fake jobs that do not actually exist. The purpose of the ads is simply to create the illusion of demand as an excuse to bring in even more low paid and low skilled H1B workers. In the youtube video below immigration attorneys from Cohen & Grigsby explain how they assist employers in running classified ads with the goal of NOT finding any qualified applicants; and the steps they go through to disqualify even the most qualified Americans in order to secure green cards for H-1B workers. Watch in the video what corporations and Congress really mean by a "shortage of skilled U.S. workers". Microsoft, Oracle, Hewlett-Packard and thousands of other companies are running fake ads for fake workers for fake jobs in Sunday newspapers across the country each week.

http://www.youtube.com/watch?feature=player_embedded&v=TCbFEgFajGU

There is a 30 day period of time in which Americans can submit resumes for these fake jobs. However, this marketing firm supplies employers with a chart of all of the possible ways to reject the US applicants. If a US applicant is so qualified that they cannot be rejected based on their resume, they are brought in for an interview for the sole purpose of finding a “legal basis to disqualify them.”

So maybe there are not a bunch of Hi Tech Jobs... Where are any jobs?

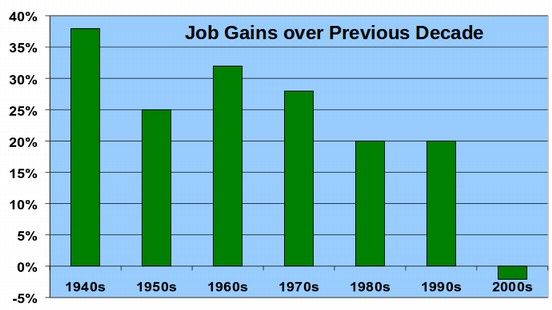

Not only are there no jobs requiring advanced math skills. There are no almost jobs at all. While job growth averaged 30% per decade from 1940 to 1980, it fell to 20% per decade for 20 years, and then disappeared completely since 2001:

Report on the American Workforce Table 12 http://www.bls.gov/opub/rtaw/stattab2.htm

After 40 years of employment growing with the population, the past decade has seen no employment growth at all. The difference between the growing work force and the stagnating jobs growth is now more than 33 million jobs – for a real unemployment rate of 25%. Washington State has 4 million workers, but only 3 million jobs. This is a real unemployment rate of 25%. The unemployment rate among those under the age of 25 is approaching 50% - and is getting worse every month!

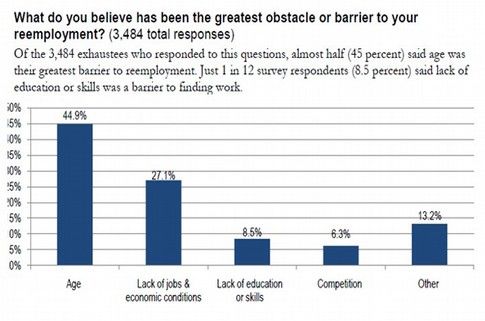

What about the corporate media claim that there are jobs and people simply need to be retrained to qualify for these jobs?

A 2011 Survey done by the Washington State Employment Security Department of thousands of long term unemployed workers – unemployed more than 2 years - found that three in four had not been able to find a job despite years of looking. The reason they could not find a job was not lack of training. In fact, many were over-qualified for the jobs they were applying for. Instead, most felt the biggest obstacle was their age. Most employers simply do not want to hire older workers.

Less than one in ten felt it was a lack of education. Instead, it was a lack of jobs. More than 600 unemployed teachers applied for a single teaching job.

Less than one in ten felt it was a lack of education. Instead, it was a lack of jobs. More than 600 unemployed teachers applied for a single teaching job. What is needed is not more training. It is more jobs!

We have a jobs crisis worse than the Great Depression and yet we have billionaires claiming that the solution to this problem is to flunk more kids trying to get their GED. What we really need to do is stop listening to the billionaires and stop giving the billionaires billions of dollars in tax breaks and start enforcing a fair tax structure and hire back all of the teachers. We also need to put a few of the billionaires in jail for tax evasion and for bribing our elected officials.

Why about the 4 million jobs that go unfilled each month?

Let's look at some of these invisible job openings. According to the Bureau of Labor Statistics. (BLS) May 2014 report, the number of positions waiting to be filled was 4 million in March 2014 and also 4 million in February 2014.But what the BLS fails to mention is that none of these were new jobs. Instead, there are always 4 million jobs waiting to be filled! http://www.bls.gov/news.release/archives/jolts_05092014.htm

What is relevant is that there were about 2.6 unemployed people vying for every opening in March, up from about 1.8 when the last recession began in December 2007. So if the GED test takers get better at math, the best they can hope for is to get in line with all of the rest of the highly qualified people who are unable to get jobs – regardless of their training. But even if they did get jobs, the odds are extremely high that their job would only be a low paying part time job.

Nearly all current available jobs are low wage part time jobs that do not require advanced math skills

According to the BLS Household survey, of 1 million jobs created in 2013, 77% were part time jobs. Compared to December 2007, when the recession officially began, there are 5.8 million fewer Americans working full time. Between 2007 to 2013, there was an increase of 2.8 million working part time. In the past, before the corporate takeover of our government, the ratio of full time to part time jobs was about 1 to 1. Currently, the ratio of part time to full time new jobs is 4 to 1 and rising. The problem with unemployment has nothing to do with the qualifications of workers and everything to do with the greed and corruption of billionaires. Trickle down economics simply does not work.

Will even having a full time job provide a living wage?

Even if one was lucky enough to have a full time job, the average worker is working 34 hours per week. The average wage is $10 per hour. http://www.bls.gov/data/#employment

That is $340 per week or about $1400 per month. Given that rent averages $1,000 per month and food averages $400 per month, it is pretty obvious that there is a problem here even if a person does manage to get a job.

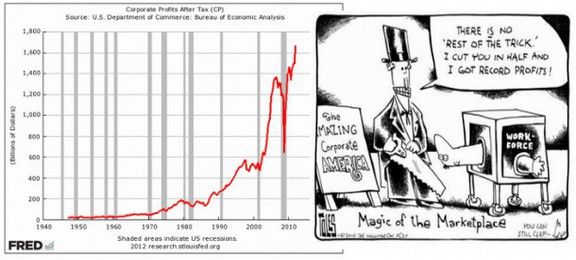

Corporate Profits now at a Record High of $1.7 Trillion per Year

While billionaires get record profits, half of Americans earn less than $35,000 a year, half of all students are eligible for free and reduced lunches, and a record 50 million Americans are on food stamps.

What is the Real Solution to the Record Unemployment Problem?

We do not need to flunk kids on the GED test. Instead, we need a fair tax structure – requiring billionaires like Bill Gates to pay their fair share of State and federal taxes - so we can create a full employment economy. We need to turn all of our unemployment offices into employment offices so people get employment checks instead of unemployment checks. The cost of a Full Employment program would be almost nothing. According to Learning from the New Deal, http://www.philipharvey.info/newdeal.pdf, a 2010 paper written by Rutgers University professor of law and economics Philip Harvey, a full employment program would pay for itself over the course of a business cycle.

Harvey's proposal is that instead of giving nearly a trillion dollars to the super rich and then hoping the benefit will trickle down in the form of jobs for the rest of us, that we eliminate the greedy Wall Street banker – middle men and simply create direct public employment jobs. We have learned from the 2009 stimulus package that when you give money to billionaires all they do with it is engage in stock market speculation – leading to the current jobless “recovery.” The problem is that without jobs, there can be no recovery – only another economic collapse once the Wall Street gamblers have blown away the money Congress gave them. Rather than being an “Employer of Last Resort” (ELR) program, the intention of the New Deal program is not merely to provide jobs for those in need, but to serve a useful and beneficial public service – such as education, child care, health care, senior care and the creation of efficient public energy in the communities where those in need live.

“In short, communities would be encouraged to view their unemployed members as an untapped resource rather than as a burden.” (Harvey, Page 23)

What is significant about Harvey's study is the conclusion that a direct jobs program would provide 5 to 6 times the number of jobs as a program which merely gives tax breaks to the super rich with the hope that the jobs will trickle down to the rest of us. Having everyone working increases tax revenue and saves billions of dollars on the cost of unemployment insurance, food stamps and other safety net programs. These public workers will spend their earnings on local community businesses creating even more jobs. The bottom line is a Full employment is cheaper than rampant unemployment.

We need to demand an economy which has jobs for everyone. The media is saying that our public schools, teachers and students are the problem when they are not. Corporate propaganda is the problem; an off-shoring of our economy is the problem; too big to fail and deregulated banks are the problem. We need to focus on solving the real problems, not the fake problems which serve only to demean the people and increase corporate profit and power for the billionaires. We need to elect leaders who are willing to face and solve real problems. We need to all join together to turn this ship around.

How Tax Fairness Can Restore School Funding and Full Employment

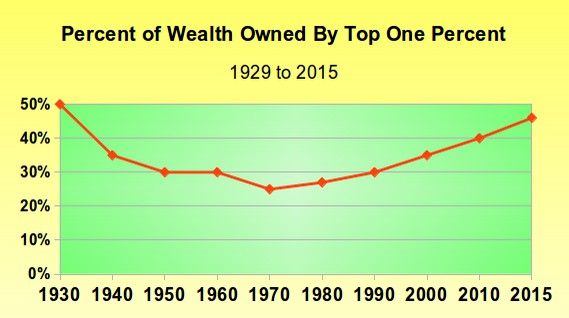

Washington, like nearly all states is facing a school funding crisis in addition to record unemployment. Both have the same underlying causes: a concentration of wealth in the hands of a few. The Top One Percent now owns 46% of the nation's wealth. The concentration of wealth is now nearly as high as it was at the start of the Great Depression in 1929.

Source: Saez and Zucman, October 2014, National Bureau of Economic Research http://gabriel-zucman.eu/files/SaezZucman2014.pdf

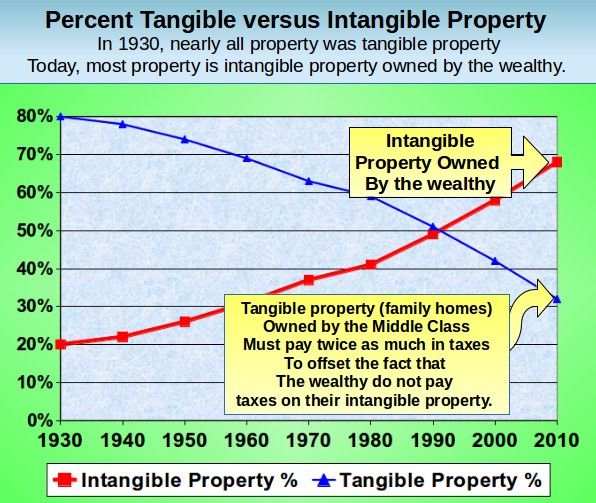

For the bottom 90%, wealth has not grown at all since 1986. For the top 1 percent, wealth has risen 5% per year. Almost half of all adults have no net worth. Almost half of all children are now living at or near poverty. Wealth is now ten times more concentrated than income. The growth of wealth at the very top is driven by a rapid rise in the value of intangible property – stocks and bonds owned mainly by the wealthy. Tangible property, such as houses, has played almost no role in the concentration of wealth. In 1978, the top 0.01% were 220 times richer than the average family. In 2012, they are 1,120 times richer.

Requiring millionaires to pay their fair share of State taxes would also help our economy

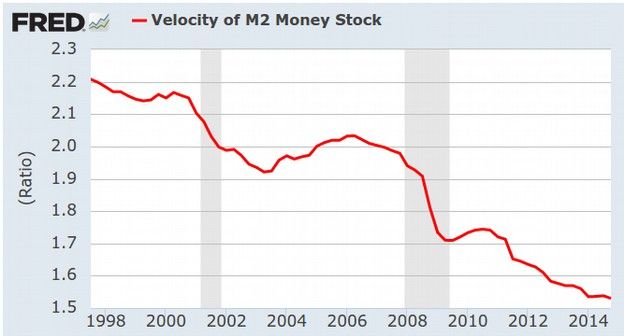

Thanks to billions of dollars in State and federal tax breaks since 2000, millionaires have more than doubled their wealth in the past 20 years, from owning 20% of our wealth to 46%. Taxing millionaires to reduce this concentration of wealth would help restore jobs and revive our economy by putting more money back into circulation. Concentration of wealth stops the flow of money in our economy because billionaires do not spend the money they receive. This stops the flow of money in our economy just like a blood clot stops the circulation of blood in the body. This unhealthy concentration of wealth is extremely harmful to our economy. The problem with extreme concentration of wealth is that rich people do not spend their money. This leads to an extreme drop in money velocity which eventually crashes the economy.

Here is the drop in Money Velocity since 1997:

https://research.stlouisfed.org/fred2/series/M2V

If we have learned anything during the past 10 years, it is that “Trickle Down” economics does not work. The problem with funneling all of the nation’s wealth to the richest one percent is that they don’t spend it. This takes billions of dollars out of the economy every year. By contrast, our poor and middle class spend every penny they take in. This spending, called Bottom Up Economics is what really keeps our economy going. When the poor and middle class run out of money, due to skyrocketing health care and energy costs, the economy suffers. Every billion dollars taken back from billionaires and re-invested in the economy restores nearly 33,000 jobs. Ironically, in helping to restore the economy by paying their fair share of State taxes, millionaires would likely gain more in additional income than they paid in additional taxes. Everyone wins when working class families have good jobs and are able to stay in their homes and have their kids go to good schools.

Washington Senate Bill 6093... An Example of Wealth Fairness State Property Tax Reform

We have written a bill that can be used as a model for state tax reform for the entire nation. Washington Senate Bill 6093, the School Funding Through Tax Fairness Act, would provide an additional $4 billion per year to restore school funding and lower class sizes in Washington state by repealing a state property tax exemption on intangible property used by the wealthy to avoid paying their fair share of state taxes. Here is the link to this bill:

http://app.leg.wa.gov/billinfo/summary.aspx?bill=6093&year=2015

What is Intangible Property? Tangible property is property you can touch –such as homes and commercial buildings. Intangible property includes all other forms of wealth – such as stocks, bonds and computer programs. With the concentration of wealth in the hands of the very rich, the value of intangible property is now much greater than the value of tangible property.

Historically, intangible property accounted for a very small percent of all property. However, with the concentration of wealth in the hands of the richest one percent, intangible property now account for over 70% of all property. Over 90% of intangible wealth is owned by the top one percent of our richest citizens. It is time for a fairer property tax structure.

It is no mere coincidence that every State has been short changing our public schools by billions of dollars a year ever since. As a direct result of this massive and unwise State tax give away, as well as the federal tax cuts since then, the wealth of the richest one percent of our population has DOUBLED in the past 20 years from 20% of our total wealth to 40% of our total wealth.

In the face of the current school funding crisis, we can no longer afford this tax give away for the super rich while our school children get the shaft. The School Funding Through Tax Fairness Act would exempt all retirement accounts and all personal intangible property up to $200,000. It thus only applies to the richest 1% of our citizens. It would not even harm millionaires as they could deduct their state taxes from their federal taxes. So this bill is really a transfer of four billion dollars from the federal tax rolls to the state tax rolls.

Repealing the Intangible Property Tax Exemption is the best way to restore school funding without raising taxes on our poor or middle class. It is adequate, fair, simple and transparent. It also has the benefit of not being a new tax. It is merely repealing an unwise and unfair tax exemption.

School Funding Through Tax Fairness Act Promotes Home Ownership

The School Funding Through Tax Fairness Act would also reward middle class home ownership with tax breaks for middle class homeowners instead of promoting stock market speculation with tax breaks for the intangible property of billionaires.

Let's compare the current tangible property tax of a typical King County homeowner to the world's richest billionaire who also lives in King County. A typical family in King County owns a $300,000 home on which they owe $200,000 and pay $4,000 in property taxes. Their combined income before taxes is about $50,000 and their combined net worth is $200,00 - $100,000 in retirement savings and $100,000 in home equity. They not only pay property tax on their $100,000 equity in their home – they pay property tax on the $200,000 in home value owned by the bank! Their property tax bill is currently 8% of their total combined income.

Under the School Funding Through Tax Fairness Act, each parent would receive a property tax exemption for $200,000 – lowering their property tax bill to ZERO and saving the family $4,000 per year and lowering the percent of their income they pay in property taxes to 0% of income.

By contrast, Bill Gates has an income of over $10 billion per year and a total net worth of over $100 billion – nearly all of which is in the form of intangible property such as stocks and bonds. Therefore Bill Gates pays less than one percent of his income in property taxes. Under the School Funding Through Tax Fairness Act, Bill Gates would pay a property tax of about one billion dollars per year – or 10% of his annual income – but he could also deduct the entire one billion dollars from his federal taxes – so he is still really paying almost nothing!

The solution to the problem of inadequate jobs and inadequate school funding is to restore a fairner tax structure by requiring the wealthy to pay their fair share of state and federal taxes as they did in the 1950s and 1960s. For more information on the School Funding Through Tax Fairness Act, visit our website: washingtontaxfairnesscoalition.org