In our last section, we noted that K12 INC started its first online school in Pennsylvania in September 2001 – just in time for the 911 disaster. Here we will calculate the cost to tax payers of this and other K12 INC fake online ed scams. The total is now in the billions of dollars and rising every year.

Calculating the Total Harm to Tax Payers

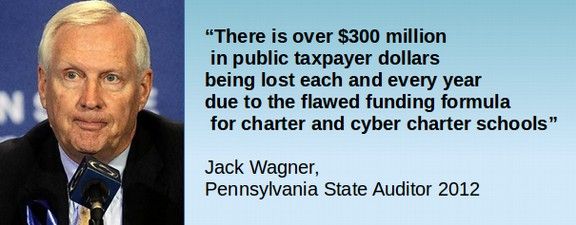

Currently, PAVCS is one of the largest online schools in the country and has about 10,000 students in Grades K through 12. It spends more than one million dollars per year just on advertising! In 2005, K12 INC set up another cyber school in Pennsylvania called Agora. It also has about 10,000 students. Pennsylvania tax payers give these schools about $8,000 per student. The total sucked out of Pennsylvania tax payers is therefore about $160 million per year – or about 20% of K12 INC's annual revenue. For this massive amount of money, PAVCS and Agora have among the lowest test scores and highest drop out rates of any school in the nation. Combine this with $140 million sucked out of Pennsylvania by gold digger poorly performing charter schools and the total loss to Pennsylvania tax payers is more than $300 million per year.

http://thenotebook.org/blog/125416/pa-auditor-general-blasts-cyber-charter-funding-again/

One former teacher from Pennsylvania's Agora Cyber Charter School, which is run by K12 Inc., said she was assigned 300 students but had no idea how many attended class. Here is a quote from this teacher: "I taught English at Agora from 2010-12. It was a horrible experience. When I started, I was assigned 300 students, which was very, very overwhelming. For each class, I'd have maybe seven out of 30 students attend – and even among those seven, just because their name was there showing them present doesn't mean they were at their computers. A huge portion of my students never showed up or did anything. I have no clue what happened to them, though I have no doubt Agora was charging the state for them. When it came time to give grades, I was told, whatever I had to do, I had to pass every student. I would not say there was much learning going on.”

One does not have to look far to figure out why the Pennsylvania State legislature allows K12 INC and other charter scam artists to steal $300 million per year from the State taxpayers. Just since 2007, K12 Inc. has spent $681,000 on lobbying, according to the New York Times. It has 11 registered lobbyists, according to the National Institute on Money in State Politics. K12 Inc. has also used a fake grassroots group called “Pennsylvania Families for Public Cyber Schools” to lobby for it. This fake K12 Inc. funded group spent $250,000 on lobbying in the last five years, with all of the money coming from K12 INC according to the New York Times. The head of K12 INC, Ron Packard, has called lobbying (also known as bribery) a “core competency” at K12 INC.

http://www.nytimes.com/2011/12/13/education/online-schools-score-better-on-wall-street-than-in-classrooms.html?_r=0

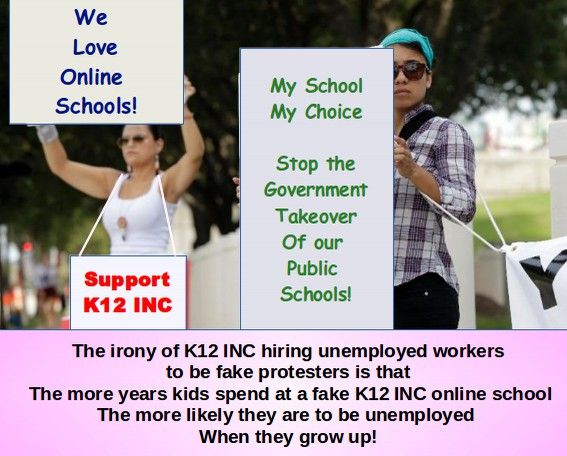

In 2002, K12 INC added the Ohio Virtual Academy (OVA). OVA currently has about 13,000 students sucking about $100 million per year out of Ohio tax payers. It also has extremely low test scores and an extremely high student drop out rate. In 2012, K12’s OVA had a 30 percent on-time graduation rate, compared with a state average of 78 percent. K12's Pennsylvania online charter schools did even worse. Their on-time graduation rate was only 12 percent compared with 72 percent statewide in Pennsylvania. One does not have to look long to figure out why the Ohio State legislature allows K12 INC to steal $100 million per year from Ohio tax payers. The New York Times 2012 article also reports that K12 Inc. is connected to a fake grassroots group called “My School, My Choice.” This fake group organized protests in Ohio against reforming the state formula for financing charter and online schools. The protesters turned out to be paid temp agency workers. Tim Dirrim, the founder of “My School, My Choice,” is the board president of the K12 Inc. managed Ohio Virtual Academy!

A sharp reporter interviewed a couple of the protesters – who openly admitted that they were temp workers who had been paid to protest in favor of online charter schools!

Also in 2002, K12 INC added the California Virtual Academy (CAVA).

CAVA currently has online programs in 10 different locations in California with a total of about 8,000 students for a total cost to California tax payers of about $70 million. Almost half of these students are in the Los Angeles School District – meaning that the loss to the Los Angeles School district is about $40 million per year. At this point, we should explain that in nearly every State, K12 INC offers school districts who “sponsor” them a bribe or kickback of about 5% of whatever K12 INC takes in. So it is likely that the LA school district got about about a $2 million kickback. But K12 INC likely got the other $38 million. It is hard to tell precisely with K12 INC because they have hidden contracts which very from State to State and even from School District to School District.

Also in 2002, K12 INC added the Wisconsin Virtual Academy (WIVA). K12 INC made a deal with the Northern Ozaukee School Board and started with 455 students. The school district got four percent of whatever public funding K12 took in. However, because they were advertising in other school districts and robbing kids from other school districts, there was a lot of conflict and eventually in 2008, the whole program temporarily shut down. In 2009, the program was moved to a new school district, the McFarland School District. It currently has about 1,000 students costing Wisconsin State tax payers about $8 million per year.

In 2003, K12 INC added Colorado Virtual Academy (COVA), which currently has more than 5,000 students and costs Colorado tax payers about $40 million per year. A 2011 study found that over half of all K12 INC students in Colorado fail to make it through even a single year before dropping out of the program. The graduation rate is only 25%! http://gazette.com/article/126009

A former teacher from the Colorado Virtual Academy said, "Three-quarters of my credit recovery kids never logged in, never completed any work, never answered their emails or phone calls, yet they remained on my class rosters. I began wondering about the state-mandated hours for students at the high school level. No one is monitoring this as far as I can see."

According to the New York Times, a Colorado state audit found that the Colorado Virtual Academy received money for 120 students whose enrollment could not be verified. The state ordered the online school to reimburse $800,000 dollars.

Also in 2003, K12 INC added the Arizona Virtual Academy (AZVA) which currently has about 4,000 students costing Arizona tax payers about $32 million per year. This scam operation was caught a couple of years ago outsourcing student essays and other private data to a sweat shop in India.

In 2004, K12 INC added the Idaho Virtual Academy (IDVA), which currently has about 3,000 students and costs Idaho tax payers about $2 million per year. Like all of the other K12 INC schools it has extremely low test scores, extremely high turnover of teachers, grossly inflated class sizes and a very high dropout rate. Here is what one former parent wrote: “If I could rate this school any lower I would. We have had nothing but problems with them. Our children cant access their site most days and when they do get on it runs sooooooo slow...our children are falling behind because half the time they cannot access their site. You can complain till your blue in the face but they don't care. This is a terrible home school company. We're having more problems than I can list. Please do your research and see for yourself. Not worth it...NOT WORTH IT”

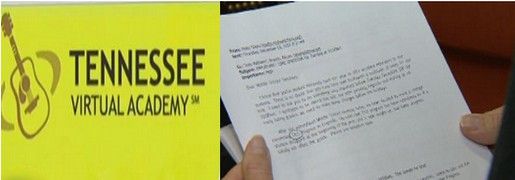

Also in 2004, K12 INC and a corporate profit driven front group called ALECproposed “model legislation” for States to use to make it easier for K12 INC to come in and rob from the tax payers. K12 INC is one of ALEC's primary sponsors. This model law was later passed in States all across the US. For example, soon after passage of ALEC law in Tennessee in 2011 - making private virtual school operators eligible to receive public funds - K12 Inc. received a contract allowing it to provide virtual education to any Tennessee student. Tennessee lawmakers also closed down Tennessee's former State-run successful online education program so that K12 INC would not have to compete with the much better state program.

Just 2 years later, in 2013, Tennessee, education commissioner Kevin Huffman threatened to close the K12 INC school. Kevin said that Tennessee Virtual Academy has test results “in the bottom of the bottom tier” and is an “abject failure.” Also in 2013, a K12 INC school in Tennessee sent an email to a teacher telling her to simple delete bad grades in order to increase the pass rate of her students. Here is a quote from the article:

“NASHVILLE, Tenn. Are leaders of a for-profit public school trying to hide the fact their students are failing? That's the question that some are asking tonight as a result of an email uncovered by News Channel 5 Investigates. At the center of the controversy is the Tennessee Virtual Academy -- a for-profit, online public school that Republican lawmakers touted as a way to improve education in Tennessee. Two years ago, state lawmakers voted to let K12 Inc. open the school, using millions of taxpayer dollars. But, now, those lawmakers are concerned about standardized test results that put it among the worst schools in the state. In fact, the email suggests that even school leaders are becoming increasingly concerned by how their students' grades may look to parents and the public...

The email -- labeled "important -- was written in December by the Tennessee Virtual Academy's vice principal to middle school teachers. "After ... looking at so many failing grades, we need to make some changes before the holidays," the email begins. Among the changes: Each teacher "needs to take out the October and September progress [reports]; delete it so that all that is showing is November progress.” http://video.newschannel5.com/story/21129693/email-directs-teachers-to-delete-bad-grades

In 2006, the head of Chicago Schools, Arne Duncan brought K12 INC to the Chicago Public Schools with a “no-bid” contract. The fake charter school is calledChicago Virtual Charter School (CVCS). The school currently has about 1000 students.

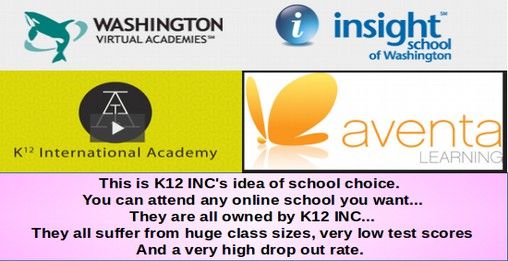

Also in 2006, K12 INC started the Washington Virtual Academy (WAVA) by arranging a bribery and kickback “sponsorship” with the Steilacoom School District in Washington State. In May 2005, the Washington State legislature passed Senate Bill 5828 to allow K12 INC into Washington State. This very bad bill amazingly had the support of the Washington Education Association – the teachers union in Washington State – even though it led to the firing of more than one thousand public school teachers in Washington State as any student in any other school district could sign up for this corrupt program and their home school district would lose $8,000 per student nearly all of which would be passed through the Steilacoom School District to K21 INC! Multiply $8,000 times 8,000 students and the loss to Washington State tax payers is $64 million – or enough to higher 640 normal public school teachers! Within a couple of years, Washington State had several online programs besides the WAVA program. These including Insight Schools (with a bribe and kickback scheme “sponsored by the “Quillayute School district) and Aventa Learning (with a bribe and kickback scheme sponsored by the East Valley School District). However since K12 INC owned all of these programs, there was only the appearance of choice. In reality, nearly all of the money for online education in Washington State goes to K12 INC. In the next section, we will review the terrible results of these programs.

In 2007, K12 INC started the Georgia Virtual Academy (later called the Georgia Cyber Academy) which currently has 12,000 students costs the taxpayers of the State of Georgia about $10 million per year. In 2012, after complaints from several parents, the Georgia State Board of Education condemned the Georgia Cyber Academy for enrolling more than one thousand special needs students without the capacity to assess or teach special needs students.

http://www.ajc.com/news/news/local-education/georgia-cyber-academy-assailed-for-missing-special/nS5sH/

2007 K12 INC Goes Public and Makes a Killing

In 2007, K12 INC promotion plan (also known as a bribery and kickback scheme) was working brilliantly. So Ron Packard and Michael Milken decided to take their ponzi scheme public so they could start cashing in their chips before the parents got wise to the scheme and started jumping ship. According to K12's 2007 stock offering prospectus, K12 INC got nearly half of their total revenues from just four States – Pennsylvania, Ohio, Arizona and Colorado. (This is still pretty much the case today as we will show in a few minutes.). 2007 was the height of a stock market bubble fueled by a rapid rise in housing prices. Who could have known that in just a few months, the Housing Ponzi Scheme was going to come crashing down? For now, it was time for Ron and Mike to cash in on the Online Education Ponzi Scheme. To arrange this stock Public Offering (also known as a Public Fleecing), they chose a highly respected investment firm called Bear Sterns – which strangely blew up in 2008 at the hands of none other than Goldman Sachs. Perhaps it was all just an unlucky coincidence. For awhile, everything looked great. More States were signed up every year thanks to the ALEC Online Charter School Law. Enrollment increased every year.

http://nepc.colorado.edu/files/virtual-2014-all-final.pdf

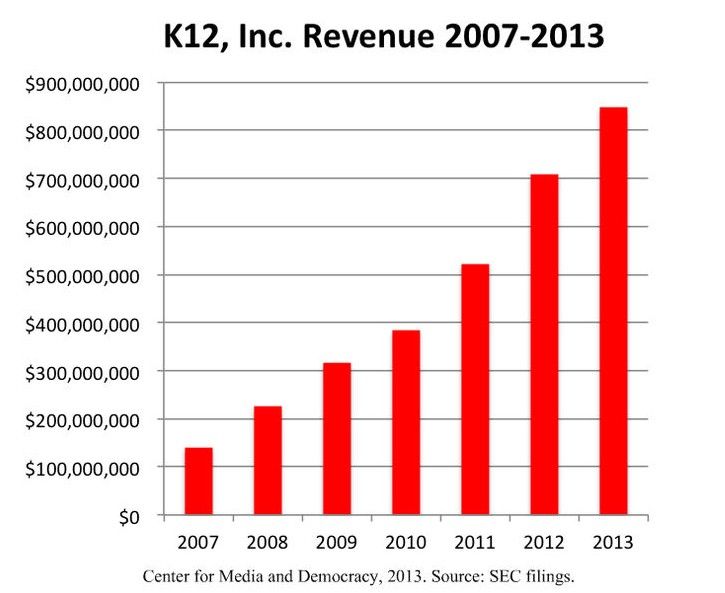

Revenue also increased every year.

Revenue also increased every year.

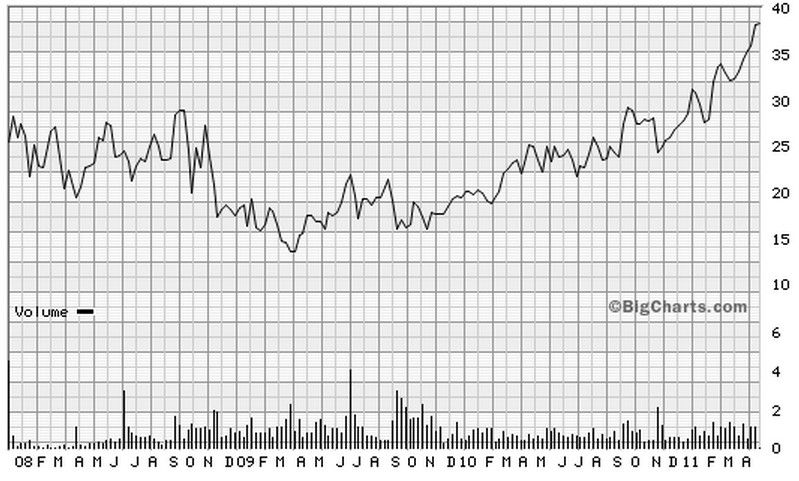

The stock opened at about $25 a share. The stock price took a hit during the Stock Market crash of 2008 reaching a low of about $12 a share. But then thanks to the Federal Reserve Free Money program, also called Quantitative Easing, the stock more than tripled to almost $40 a share on April 24, 2011.

http://www.marketwatch.com/investing/stock/lrn/charts

But then reality started to set in as study after study from State after State consistently showed that the students were not learning from the K12 INC magic learning program – which also meant that the drop out rate was very high. In addition, there was a lawsuit from investors in 2012 claiming they were given false information in 2010 and 2011 by K12 INC CEO Ron Packard.

A Double Whammy... The Truth About K12 INC “Drop Out Rates” Finally Comes Out

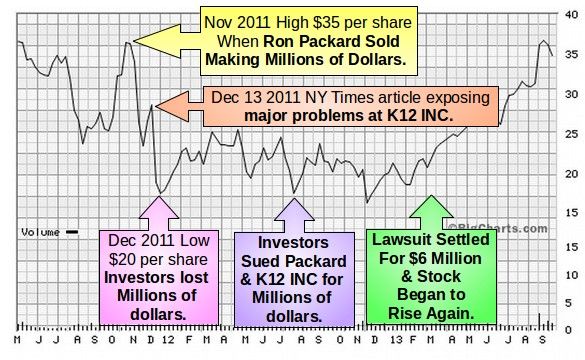

During the summer of 2011, K12 INC CEO Ron Packard made extremely bullish statements about future student enrollment and revenue growth. This caused K12 INC stock to rise sharply. Then in October and early November 2011, Ron Packard sold millions of dollars in stock options. Finally, on November 16 2011, Packard admitted for the first time that nearly half of all K12 INC students drop out during their first year (only to be replaced by even more students who also drop out) and therefore the promised profits were not likely to happen.

Within days K12 INC stock plunged. Then, on December 13, 2011 a New York Times article entitled "Profits and Questions at Online Charter Schools" revealed, among other things, that K12’s schools had extremely high drop out rates – even higher than what Packard had told investors on November 16 2011. K12’s stock price plummeted 23.6% the very next day reaching a low of $20 per share on December 15 2011. This led to an Investors lawsuit in 2012.

Using Lies to Fool Parents and Children into Enrolling at K12 INC

In sworn declarations with the 2012 lawsuit, former sales employees at K12's call centers described high pressure to make huge enrollment quotas in order to get a commission. Sales employees were provided with a "script" of what to say to prospective students and parents, including purported "statistics" showing that K12 students were years more advanced than brick-and-mortar school students.

Here are a summaries of former K12 INC Call Center Workers:

CW2 described a toxic work environment where sales staff were pressured to meet unrealistic quotas, frequently being forced to make as many as 200 outgoing calls daily to keep up. Sales staff were never given any actual data of student performance, but were instead fed statistics from K12's website, and were told to tell parents that students who did the K12 program for 1-2 years performed better than their peers at brick and mortar schools.

CW4 stated that there was constant pressure to generate sales, describing the Company's sales philosophy as "enroll, enroll, enroll." CW4 stated that enrollment consultants were instructed to refer to the performance of K12 students as "comparable [to] or even better" than the performance of students at traditional schools, and to state that students at K12 schools were "on a better tier" than those at traditional schools. Source: K12 INC lawsuit 6/22/12

In fact, as we will show in the next section, half of all K12 INC students drop out during their first year and only one out of four every graduates from high school. The 2012 lawsuit was finally settled in early 2013 for $6 million.

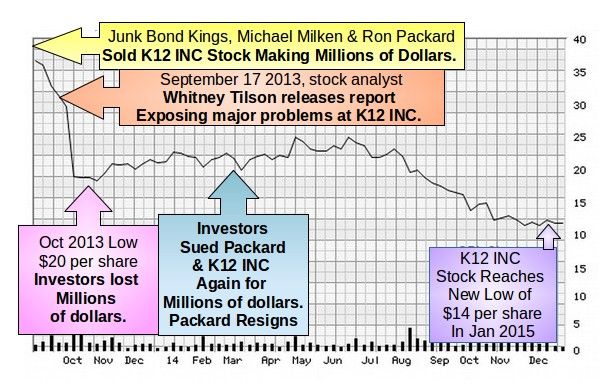

During the summer of 2013, Ron Packard assured everyone that the trouble from 2011 was over and all of the K12 INC problems had been solved. Then a miracle happened. K12 INC stock started to rise again. It was almost as if some billionaire was pushing the stock price up. By early September 2013, the stock price was back up to $36 per share. It was magic!

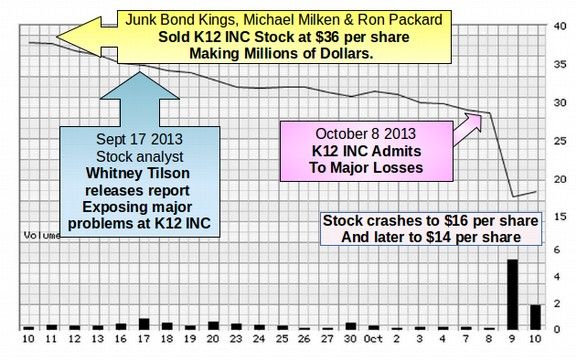

Sadly, the magic did not last long. As the next chart shows, within days of reaching its high of $36 a share in early September 2013, the stock began to plunge. For the rest of 2013 and all of 2014, it continued to plunge. It was as if someone had pulled the rug out from under K12 INC's investors. As we will show next, this is exactly what happened.

Junk Bond King Michael Milken Jumps Ship - Leaving the Public Holding the Bag

Between September 1, 2013 and October 1, 2013, the stock price of K12 INC fell from $36 a share to $20 a share. There were two reasons for this sudden plunge. The first was that the Junk Bond King had decided to walk away from his Ed Reform Toy. He had been quietly selling his K12 INC stock until by September 2013, he had no stock left in K12 INC. Ron Packard had also been selling his stock. Both Ron Packard and Michael Milken made millions of dollars pumping the stock up and then dumping it. This is actually what market traders call this kind of rigging – pumping and dumping. The rest of us in the general public call this a Ponzi Scheme – and we get left with massive losses.

K12 INC stock remained at about $20 per share for nearly a year – even though Ron Packard had announced he was leaving K12 INC in January 2014. Then in August 2014, the next batch of K12 INC test scores were released by States around the nation. The test scores were horrible. The stock has been in a nose dive ever since. It is currently at a record low of $14 a share. Our advice is to sell now – because eventually this stock is going to be worthless – just like every other Ponzi Scheme.

The Big Short

The other thing that happened in September 2013 was a report released by a major stock analyst and hedge fund manager named Whitney Tilsonwho somehow figured out that Michael Milken and Ron Packard had been selling all of their shares. Whitney did some research and found out that K12 INC was not all it had been cracked up to be. He reviewed the lawsuits and complaints from former teachers, students, parents and looked at the test scores and drop out rates. He then realized why Michael Milken and Ron Packard were jumping ship. It was because the K12 INC ship was sinking.

At the beginning of September, Whitney told his investors about the sinking ship and encouraged them to “short” the stock. This is a Wall Street gamble where you bet the stock is going to fall and if it does, then you make a huge amount of money. On September 17, 2013, Whitney also went public with a 125-page slide showvividly describing why the K12 INC ship was going to sink. In particular, he spilled the beans about Michael Milken's company (called Knowledge Universe) recently distributed all of their remaining shares in K12 INC and he spilled the beans about Ron Packard selling a huge number of shares. Whitney's slide show made it clear that K12 INC was nothing more than a house of cards that would eventually fall over.

http://www.tilsonfunds.com/K12-Tilson-9-17-13.pdf

Whitney said in an interview, "When you introduce unlimited government money and virtually no government regulation, the industry will run amok."

Whitney noted that K12 Inc. had hired 153 lobbyists in 28 states from 2003 to 2012. But not even 153 lobbyists can save a company from a bad business model. Any school that has a drop out rate of more than 50% per year is eventually going to fail. Parents will eventually find out. And they will no longer send their kids to a program where most were certain to fail.

Another Double Whammy... Double Talk from Double Crossers

As if the harsh critique from Whitney Tilson was not bad enough, in a statement on October 8, 2013, K12 INC admitted for the first time that its enrollment and profits would not be as high as it had earlier claimed. In Form 8-K, they lowered their revenue forecast by about $80 million compared to a forecast they have supported just a few weeks earlier!.

http://investors.k12.com/phoenix.zhtml?c=214389&p=irol-newsArticle&ID=1862757&highlight=#.VKe7A3Wx3UY

Two days later on October 10, 2014, K12 INC released a second written statement admitting that K12 INC would have a projected operating loss of about $9 million in the first quarter of fiscal 2014.

http://investors.k12.com/phoenix.zhtml?c=214389&p=irol-newsArticle&ID=1863577&highlight=#.VKe84XWx3UY

Also disclosed in this second statement was the fact that K12 INC was taking a capital expense of $80 million on its software development. In other words, it was writing it off over time. This is not generally how software is accounted for. It is usually accounted as an expense as the software is written. Only things like buildings are written off over time. So had K12 INC followed normal accounting practices, it would have actually lost $89 million in the first quarter of fiscal 2014. This was not what investors wanted to here. No wonder Ron Packard and Michael Milken had jumped ship in August 2013. They apparently had some inside information. After the October 8 announcement, K12 INC stock shares fell 38% in a single day.

Meanwhile, since K12 INC's 2007 initial public offering, Packard had made $21 million from share sales and exercising options according to Insider Score in Princeton, New Jersey. In the three months before the share drop in October 2013, Packard made about $3 million in profit from option-related sales according to Insider Score. Milken made even more of a killing. In September 2013, a month before K12’s disappointing results were announced, Milken's companies distributed about $270 million in sharesaccording to a securities filing. http://www.bloomberg.com/news/2014-11-14/k12-backed-by-milken-suffers-low-scores-as-states-resist.html

Misleading Claims, Bad News and Two Lawsuits Make for Irate Investors

The shocking revelations in October 2013 combined with the shocking information from Whitney Tilson on September 17 2013 led to the second investor lawsuit in January 2014 – this time by another group of stockholders (the Oklahoma Firefighters Pension and Retirement System – who had lost millions of dollars as a result of Ron Packard's deception). This second lawsuit, like the first one, cited overly optimistic statements made throughout the Spring and Summer of 2013 by company officials, including misleading statements Ron Packard and Nate Davis, K12’s current CEO, about the company’s ability to grow. Only later on October 8 2013 - after Milken and Packard had sold their stock –did Packard reveal that K12 INC had missed key enrollment and revenue targets.

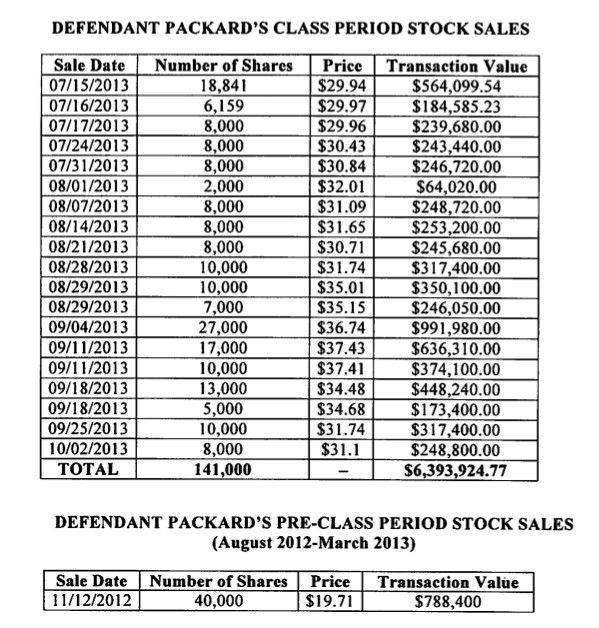

The April 2014 lawsuit, like the 2012 lawsuit, alleged that former K12 CEO Ron Packard “reaped the rewards” of the bullish company projections by selling $6.4 million dollars worth of stock in the months before an October announcement of disappointing news sent its stock price plummeting. He sold his stock at a rate that was 8 times higher than his prior rate of stock sales.

Below is a table from Page 9 of the January 2014 Complaint:

2014 Oklahoma Firefighters Pension & Retirement System versus K12 The lawsuit alleges that Ron Packard deliberately inflated the stock price of K12 INC with knowingly false and misleading statements in order to increase his profits from sales of his stock. Many examples of these false and misleading statements were given. After K12 INC finally revealed the truth, K12 stock fell by more than 38%, falling from a closing price of $28.59 on October 8, 2013 to a closing price of $17.60 on October 9, 2013.

http://www.blbglaw.com/news/press_releases/00012/_res/id=sa_File1/K12%20Complaint.pdf

The Seven Hundred Million Dollar Heist

We mentioned earlier that Milken's companies distributed $270 million in K12 INC stock before the stock crashed. However, for every winner on Wall Street, there has to be a loser. In this case, the losers were retired people who belonged to pension funds which invested in K12 INC stock. We will next estimate how much these pension funds lost as a result of the stock crashing from $36 per share in early September 2013 to $16 per share on October 9 2013. As of January 2 2015, the stock is at $11.70 per share and falling.

How many shares of K12 INC are there?

The loss from September to October 2013 was about $20 per share. The current market capitalization is $450 million at $11.70 per share. This implies that there currently are about 39 million shares of K12 INC stock. However in 2013, there were only 36 million shares of K12 INC stock.

http://www.marketwatch.com/investing/stock/lrn/financials

36 million share times $36 per share means that the market capitalization of value of all stocks in September 2013 was $1,296 million. The loss to all investors stuck with K12 INC stock in October 2013 was $20 per share times 36 million shares equals $720 million. Therefore while Michael Milken made $270 million and Ron Packard made $6.4 million and folks who are clients of Whitney Tilson made hundreds of millions, retired pensioners lost $720 million. Think of this as a transfer of wealth of $720 million from senior citizens living on a fixed income to billionaires like Michael Milken.

There are at least ten reasons to believe that the K12 INC stock crash and $700 million wealth transfer was a pump and dump operation

First, on August 29, 2013, just 40 days before the October 8 2012 K12 INC announcement that they would lose about $80 million, their chief financial officer (Rhyu) and their chief executive officer reassured investors that “we are comfortable with the fiscal 2014 estimates posted to First Call through yesterday as follows: revenue of $986.8 million.” Then on October 8 2013, they announced that revenue would only be about $900 million. This was an $80 million change in just 40 days. This was equal to an entire month of revenue.

http://www.blbglaw.com/news/press_releases/00012/_res/id=sa_File1/K12%20Complaint.pdf

Second, in the four months preceding the stock price crash, the person who knew the K12 INC stock value best, Chief Executive Officer, Ron Packard, started selling his stock stock at a rate that was 8 times faster than he had previously sold his stock.

Third, in the two months preceding the stock price crash, the person who was the founder of the company, Michael Milken, cashed in all of his chips.

Fourth, on September 17 2013, stock analyst Whitney Tilson, provided detailed information on the major problems at K12 INC. Even if K12 INC leaders were not aware that they had problems on August 29 2013 when they reassured investors that they were heading for record earnings, they certainly must have known about Whitney Tilson's Presentation which went into devastating detail about the problems at K12 INC.

Fifth, it was obvious from Whitney Tilson's presentation that he spent several months analyzing K12 INC and interviewing former employees of K12 INC. This means that Whitney suspected months before the stock actually crashed that it was going to crash. It was also clear that he told his clients that K12 INC stock was going to crash at least a full week before he told the general public. He admitted that his clients made millions of dollars on his advice by shorting the stock. It is not reasonable to conclude that Whitney knew more about K12 INC than their chief executive officer Ron Packard.

Sixth, Ron Packard had also withheld other key information from investors in the months before the stock price crash. For example, there had been a 9% decline in enrollment in the spring of 2013. This was not disclosed to investors until October 10 2013 – after the stock had already crashed.

Seventh, K12 INC leaders had used a highly questionable accounting trick to hide expenses and hide losses by “capitalizing” $80 million in software development expenses over time rather than declaring them as current expenses. Ron Packard knew they were doing this. But investors did not know until October 8 2013.

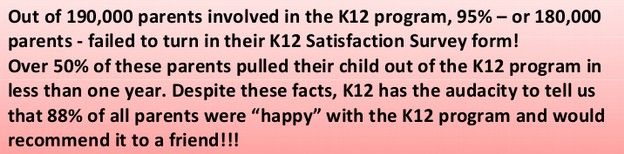

Eighth, according to the complaint filed by the Pensioners, on March 11 013, Ron Packard told investors: “Our customer satisfaction is extremely high. It has been since the very beginning.” We will provide substantial and irrefutable evidence in the next section that this statement was false and misleading and that Ron Packard knew it was false and misleading – and has known for years that it was false and misleading. The truth is that nearly 90% of all customer's – including parents and students – have a very low opinion of K12 INC – which is why K12 INC has to spend $30 million per year every year to recruit a new batch of suckers.

Ninth, this was not the first pump and dump operation pulled off by Ron Packard and Michael Milken. Both have a long history of pump and dump operations going all the way back to the 1980s – including a K12 INC pump and dump that they pulled off in 2011 which led to the 2012 investor lawsuit that was also about hiding important information from investors. The 2013 pump and dump was a mirror image of the 2011 pump and dump.

Tenth, as we will show in greater detail in the next section, the entire K12 INC operation is nothing but one huge fraudulent enterprise. There are literally hundreds of examples of K12 INC leaders lying to students, parents, teachers, legislators and investors with year after year of false and misleading statements and practices going all the way back to the hatching of the K12 INC scam in 1999.

November 5 2014 Judge Anthony Trenga Grants K12 INC Motion to Dismiss

Despite the mountains of evidence that Ron Packard and K12 INC had misled and defrauded investors, on November 5 2014 Judge Anthony Trenga granted K12 INCs motion to dismiss the complaint. Here is a link to his ruling.

https://cases.justia.com/federal/district-courts/virginia/vaedce/1:2014cv00108/302903/49/0.pdf?ts=1415302891

The judge stated: “Plaintiff is required to prove:

(1) a material misrepresentation or omission by the defendant;

(2) scienter (the defendant knew the misrepresentation was false or misleading);

(3) a connection between the misrepresentation and the purchase of a stock;

(4) reliance (by harmed investors) upon the misrepresentation or omission;

(5) economic loss; and

(6) loss causation (that the loss was caused by the misrepresentation.”

The judge then decided that it was theoretically possible that Ron Packard had no idea that K12 INC was in trouble or that the stock would crash. To make it clear, I agree that defendants should be given the “benefit of the doubt” and that the burden of proof is on the person making the allegation. However, the evidence summarized above not only meets the civil standard which is more likely than not – it also meets the criminal standard of beyond a reasonable doubt. It is simply not credible to conclude that Ron Packard had no idea that K12 INC was in trouble and he just happened to sell 43% of his stock in the 3 months before it actually crashed. If Whitney Tilson knew it was going to crash in the summer of 2013, and many of his investors knew, then so did Ron Packard. It is also beyond belief that the head financial officer of K12 INC did not know that enrollments had been down by 9% just months earlier or that revenue would be down by 9% ($80 million) just 30 days later. This was not just a coincidence. It was a predictable event.

Three Remedies... It is up to all of us to seek and demand justice

The first remedy would be for a new group of harmed K12 INC stockholders to use the evidence I provide in the next section to bring a new class action lawsuit against Ron Packard and K12 INC. The original January 2014 complaint was not well researched and not well presented to the court. Given that the total lost by investors was more than $700 million, one would assume that someone would be interested in getting their money back.

The second remedy is to use the Court of Public Opinion. If the court system will not hold Ron Packard, Michael Milken and K12 INC accountable for defrauding senior citizens of more than $700 million, then it is up to the rest of us to hold them accountable by voting with our feet and with our voices and with our cash. Do not send your kids or grand kids to any program run by K12 INC.

The third remedy is to get informed about K12 INC and then share this information with others. Take the time to read the next section. Share the link to our book and our website with other parents, teachers, seniors, legislators and concerned citizens. Together we can hold K12 INC accountable for the educational crimes they have committed against our children and the financial crimes they have committed against our senior citizens.

A Warning... The Goal of K12 INC is to Harm Even More Millions of Children

According to the 2014 Investors Complaint, in early 2013, Ron Packard told investors that K12 INC was planning a massive expansion. Here is a quote from Ron Packard: “if you look at the size of U.S. public education market, its $650 billion or it’s about 58 million kids. We have 130,000 kids today. So we can grow at a high rate for a long time. And even if you double every three years, which is about 24% growth rate, it’s a long time before you can get to the 2 million home school kids that are out there...The last count,(home school) is about 11% of the students who come into our program. The other 89% are coming from that brick-and-mortar component... So believe that high growth rates can be sustained at K12 for a long time.”

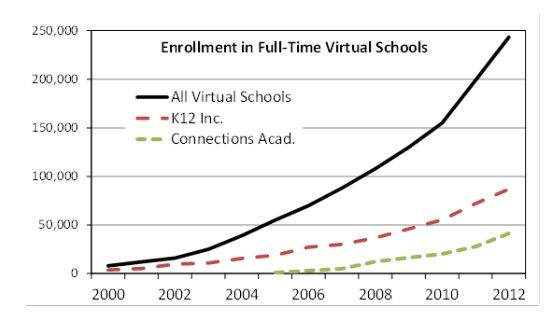

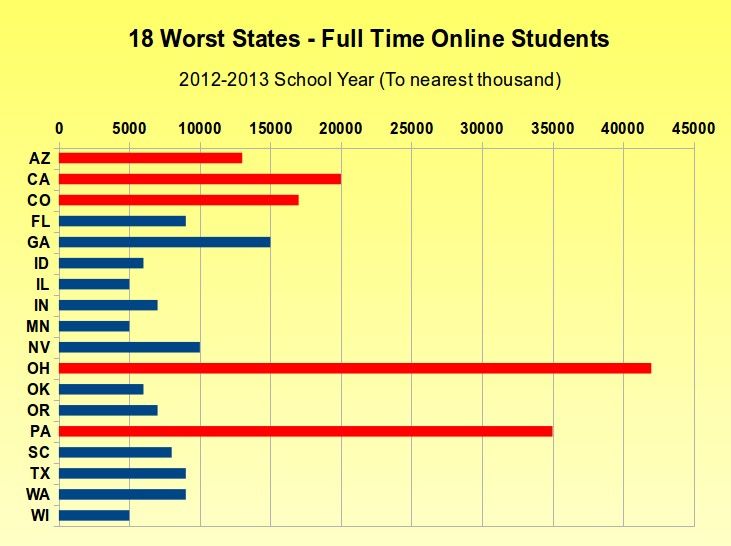

K12 INC clearly has a goal of using false and misleading advertising to expand their “market” in coming years – as if they have not already harmed enough children. With a planned growth rate of doubling every three years, they apparently want to harm millions of children every year. Below is a graph showing the numbers of children currently being harmed by K12 INC.

18 States with more than 5,000 students attending online charter schools

2012 – 2013 School Year

The 5 original K12 INC States, Arizona (2003), California (2003), Colorado (2004), Ohio (2002) and Pennsylvania (2002) are shown in red above. Note that 5 of the 6 worst States for subjecting children to online schools are the original K12 INC States. All five States were subjected to a massive K12 INC propaganda campaign that misled tens of thousands of parents and students into believing that a fake online school was better than a real public school.

http://nepc.colorado.edu/files/virtual-2014-appendix_b-numbers-final_0.pdf

My mom always said “Fool me once, shame on you, Fool me twice, shame on me.“ K12 INC has been fooling too many parents for far too long. For the sake of our children, we need to stop this corrupt monster before it grows into a cancer that destroys our schools, our kids and our democracy.

What is Next?

In the next section, we will review the bad news between 2011 and 2013 that convinced Michael Milken and Ron Packard that it was time to abandon the K12 INC ship. Given that the future of more than 100,000 children are at risk, this is a topic that every parent should know more about.